The Davidson County Assessor of Property, or Property Assessor, announced the new property values of Nashville on April 18. Results highlight that Davidson County’s median value has skyrocketed by 45% since the last reappraisal in 2021.

Highlights

- Property values have increased exponentially in the last four years in Nashville districts.

- A 45% increase was seen in Davidson County alone, which is higher than the 2021 assessment.

- Property owners can review their individual property values by appealing from April 21.

Property Values Reach a Four-Year High in Davidson County

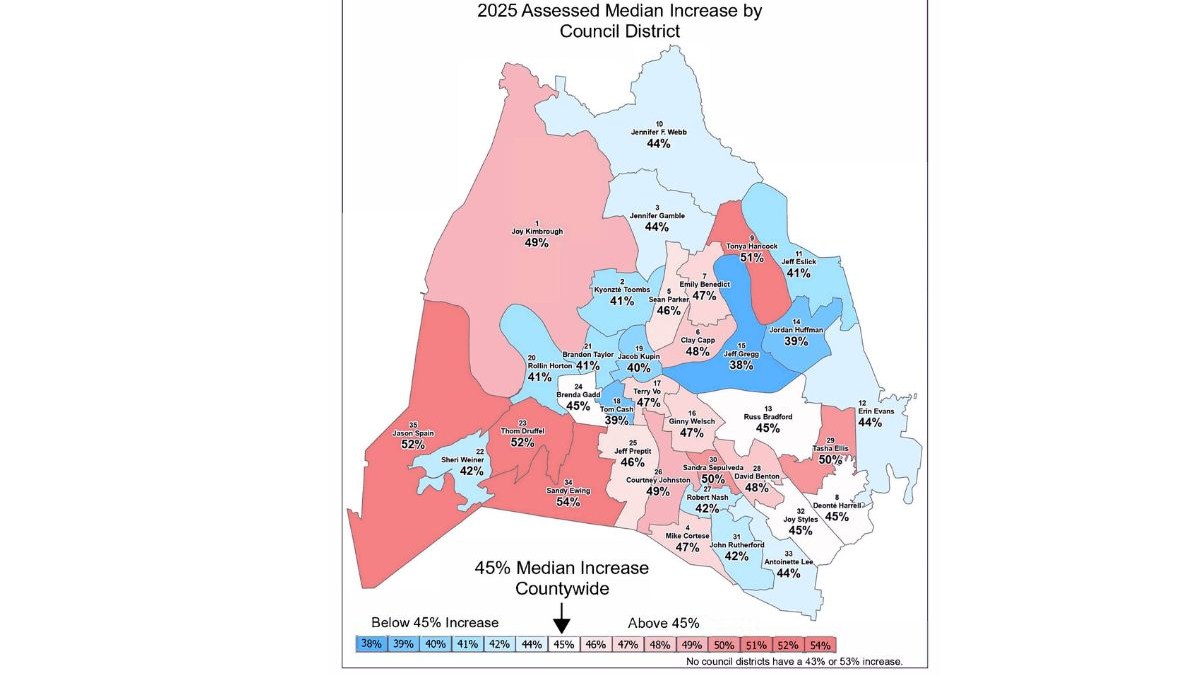

The average property value increase across Nashville was demonstrated in a map shared by the Davidson County Assessor of Property on April 18. The council districts with the red color shade went through higher increases since the 2021 assessment. Whereas, the blue-shaded ones had an increase that was below the countywide median.

The percentage increases in every council district of Nashville are a composite of commercial and residential developments. Thus, individual property increases in the districts may be quite different.

Davidson County witnessed a huge 45% increase this year, which is higher than the 2021 reassessment figure.

Property Owners Can Appeal for Viewing Their Individual Values

The price increase has been different for different Nashville districts based on location. The median rise in the metro council districts went from 38% to 54% in the last four years.

Property owners can find out their individual valuations by appealing via mail.

How and When to Appeal?

The appeal process will start for Nashville’s property owners on April 21. It should be noted that the Property Assessor has increased the appeal period this year, till May 9 (by 4 pm).

One can request the appeal process by either calling 615-862-6059 or reaching out online at www.padctn.org.

Nashville’s property owners will be provided with the requested information by June 6.

Impacts of the Reappraisal on Nashville’s Property Tax Rate

The reappraisal process can lead to authorities making modifications to Nashville’s property tax rates. The city’s law is such that it cannot take in a large amount of tax due to the reassessment. So, the Metro Council and the mayor will have to think of adjusting the tax values.

The surging property values in Nashville put the spotlight on the probable shifts in property tax rates across its districts. This will then push authorities to think about ideal solutions to move ahead.