The Q3 2025 US Multifamily MarketBeat Report has arrived, revealing the current state of the housing market. Despite the stability found nationwide, San Francisco has emerged as an exception. The market continues to grow here steadily with a good YoY leap.

San Francisco Housing Market Leads Comeback in Rent Performance and Occupancy

The post-pandemic multifamily housing market has witnessed significant changes.The nationwide housing market has faced challenges in recovering, but some cities, like San Francisco, have navigated these changes more successfully.

According to a report by Cushman & Wakefield, San Francisco has outperformed among US cities in the multifamily housing market. The Q3 2025 report shows that it has recorded the highest rent growth in the nation, from $3,394 in Q3 2024 to $3,658 in Q3 2025. Vacancy rates have also fallen to 4.9% which is significantly faster than the national average.

San Francisco’s exceptional performance is driven by its post-pandemic planning and changes. By adapting to shifting trends and evolving demands, the city has built this remarkable stability. The city’s inventory, project deliveries, and projects under construction have shifted according to demand.

One of the biggest reasons for this performance lies in San Francisco’s capital investment in AI. The wider return-to-office mandates and livability improvements have helped make this achievement. Together, these factors have positioned the Bay Area as a leader in rent growth.

San Francisco V.S. National Multifamily Housing Market

The report gives insight into the national multifamily housing market in Q3 2025. San Francisco emerges as a top-performing city in the market. The report highlights stark contrasts between San Francisco’s market and the national average.

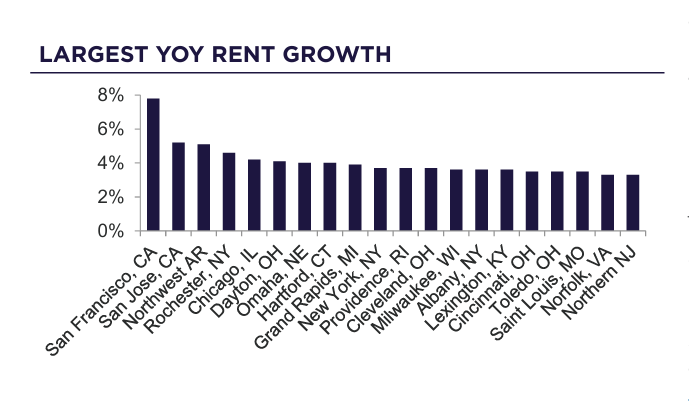

San Francisco records the highest rent growth YoY at 7.8% while the average YoY rent growth falls to 1.5% nationally. The vacancy rates are also falling faster in San Francisco, which otherwise stands at 9% nationally. And where the national average market rent is at $1,903, the rent has increased to $3,658 in Q3 2025 in San Francisco.

This data comes from Cushman & Wakefield’s latest quarterly report. It includes a variety of data sources, including third-party data sources. These numbers signify why San Francisco has been highlighted in this report.

San Francisco’s rent performance demonstrates how a market can bounce back stronger with strategic adjustments. The city has steadily bounced back from the pandemic’s setbacks, now showing stronger rent growth than ever before. This places San Francisco at the forefront of the nationwide rent performance recovery.