A new climate risk report ranks U.S. cities where homeowners face the heaviest insurance costs. Miami has topped the list, showing billions of dollars worth of real estate in high-risk areas. Homeowners in Miami also pay the highest share of insurance costs compared to other U.S. metros.

Highlights

- A new report ranks Miami at the top among cities that bear the highest homeowner insurance burden.

- A significant part of the city’s real estate is at an extreme risk of flood damage.

- Trillions worth of real estate are at extreme risk of wind damage in the city.

Miami Ranks Top Climate Risk Among U.S. Cities

Climate change has put growing pressure on the real estate industry in recent years. Yet FEMA flood maps have not kept pace with shifting risk zones, leaving some areas without timely updates. This has resulted in these areas not receiving timely aid and benefits as given to areas in the database.

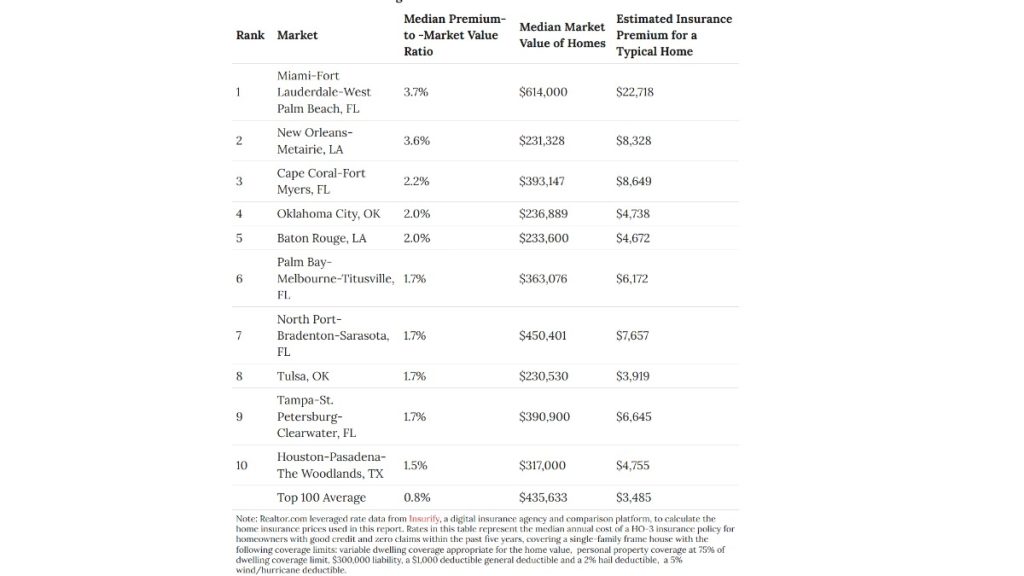

A report released by Realtor has revealed a list of U.S. cities showing how real estate has been affected by climate risks. The list reveals U.S metros where homeowners are carrying the highest insurance burden. It also highlights how insurance costs have become a major affordability issue for homeowners in these areas.

Miami has topped the list, as a significant portion of its real estate is vulnerable to floods and wind damage. It is also the U.S. metro with the highest insurance premiums, adding to affordability concerns for homeowners.

Miami Real Estate Market Tops Highest Insurance Burden Ranking

According to the report, Miami tops the 2025 list of homeowners carrying the highest burden of homeowners’ insurance. The majority of homeowners opt for government-backed insurance due to limited private options. Homeowners in Miami pay roughly 3.7% of a home’s market value annually, putting it at the top of the list.

This sums up to a number that places a heavy financial burden on homeowners. When combined with the tax burden, the number is often seen to exceed the mortgage payment. For homeowners in Miami, these combined costs can rival or even exceed mortgage payments.

Billions at High-Level Flood and Wind Risk

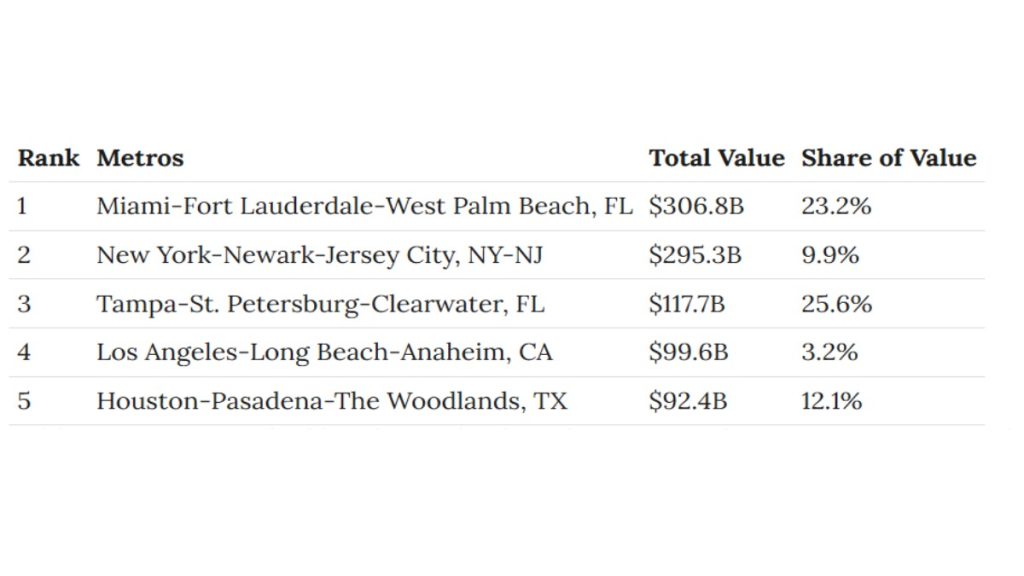

A large share of Miami’s housing market faces severe or extreme climate risk. The report by Realtor.com ranks Miami at the top with the most in total home value exposed to climate risk. Billions worth of its real estate is at risk of flood damage, while trillions in real estate are at risk of wind damage.

The report estimates that $306.8 billion in real estate, about 23.2% of the metro’s property value, is at risk of flooding. This is a significant portion of its housing market, and is constantly exposed to potentially catastrophic flooding.

Meanwhile, the full housing market in Miami is exposed to severe or extreme hurricane-force wind risk. Miami’s $1.32 trillion housing market is entirely exposed to severe hurricane-force winds. And considering its geographical location along the Atlantic hurricane corridor, it is already one of the most hurricane-prone in the U.S.

The data analysis for this report was based on the median annual cost of a standard HO-3 homeowners policy. The total property values at risk were determined based on Realtor.com’s housing database.

The report sheds light on climate risks and supports homeowners and homebuyers in making smarter decisions when investing in real estate. It also identifies regions that are greatly exposed to climate threats and exposes gaps in the current risk mapping. With stronger preparedness, homeowners and investors can better manage long-term climate risks.