A new analysis has found that the hidden costs of homeownership have hit a new high. Rising insurance, maintenance, and property tax costs are adding more pressure on buyers nationwide. The report also offers practical tips for first-time buyers navigating these hidden expenses.

Hidden Costs of Homeownership Rise Sharply

Buying a home is challenging, but hidden costs after closing can be even more daunting. Insurance, maintenance, and property taxes are often overlooked, but they can add up quickly.

A new analysis from Zillow and Thumbtack reveals that hidden costs of home ownership add up to almost $16,000 per year nationwide. These costs have risen sharply in recent years, outpacing income growth and squeezing affordability nationwide.

These hidden costs do not include mortgage payments, which are another burden on homeowners. Moreover, the analysis reveals that these hidden costs have increased 4.7% in the past year while incomes rose just 3.8%. Insurance premiums have risen 48% nationwide since February 2020.

Cities with the Highest Hidden Costs in the U.S.

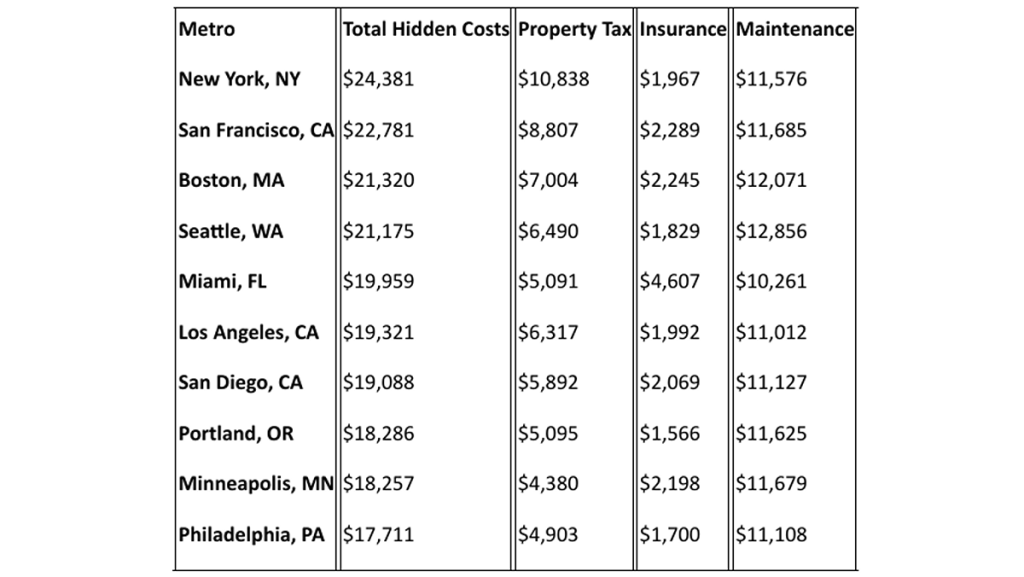

The analysis also reports cities with the highest hidden costs nationwide. Expensive coastal metros see the highest hidden costs, with New York City standing at the top. In New York City, hidden costs total $24,381, including $11,576 for maintenance and $10,838 for property taxes.

Following NYC is San Francisco, where hidden costs sum up to $22,781. The maintenance cost in the city comes up to $11,685, and the property tax amounts to $8,807. The list then continues to Boston at the third position, Seattle at the fourth position, and Miami at the fifth position.

Zillow and Thumbtack provided the data for the analysis. Zillow is a real estate app and website in the U.S. Thumbtack is a tech platform that connects homeowners with services for home maintenance and improvement.

Zillow estimated the annual property tax and homeowners’ insurance costs for a typical homeowner in the U.S. Thumbtack added the estimates for annual home maintenance costs and preventive weather-related maintenance costs. The data from the two helped curate this report.

Tips for New Buyers

With home prices climbing, first-time buyers face new challenges when entering the market. The report also shares tips to help buyers plan for costs and make smarter homebuying decisions. Here are the tips for prospective buyers:

- Knowing one’s true buying power: Zillow allows buyers to set monthly payment targets that account for hidden costs.

- Plan early for maintenance costs: With the Thumbtack app, buyers can avoid the surprise expenses and anticipate ongoing upkeep expenses.

- Reconsidering the home one buys: While large houses with big backyards may seem like a dream come true, the accompanying maintenance costs are high. Instead, buyers can opt for more affordable options that may offer less upkeep.

- New construction saves later: While upfront costs are higher, maintenance costs are typically lower in the first few years.

While there are many more ways to get the best deals, these basic points change one’s perspective when purchasing a home. These tips highlight hidden costs that buyers often overlook, making them essential for planning a purchase.